Speculators Manipulation’s Behind Oil’s Rise

by Madis Senner

|

The market system is not the fair system we perceive it to be. |

We are being ripped off, gouged by speculators who are exploiting global imbalances and geopolitical tensions to push up the price of oil. They have duped us into believing that oil prices are being driven by unusual circumstances—increased demand from China and India while supplies have remained stagnant and geopolitical tensions in the Middle East. While these factors have certainly helped raise the price of oil, they are not the dominant factor behind its rise. Speculation has driven energy prices higher. Large pools of speculative capital managed by commodity traders, hedge funds, brokers, trading desks of oil and financial companies that can leverage their capital into the trillions of dollars, have bilked us for hundreds of billions of dollars(Click to read analysis) . Not only have speculators personally profited by hundreds of billions of dollars but their price manipulations have created even greater windfall profits for giant oil companies and OPEC nations.

Even before the price of oil topped $75 a barrel cries were heard that speculator’s were contributing to, if not driving oil higher in price. Publications like Business week while admitting that supply-and-demand issues influences prices also asked: “But how much of crude's big bounce is also because of speculation -- hedge funds and other financial players pushing up the price in futures markets?”[1]

The Times of London went even further noting how speculators have been able to do what OPEC could not do, fix prices :

“Traders can hold the world economy to ransom because short-term demand and supply are inflexible, but also because they dominate dealings on oil markets… The tail wags the dog in many commodity markets, wildly exaggerating the ups and downs of demand and supply. In oil markets, the tail wags an elephant.”[2]Global Investment Banker Morgan Stanley concurs that, “Financial speculation is the key driver of oil prices”[3] , as do governments[4] , oil executives at major oil companies[5] and even OPEC[6] itself.

What has changed since the last oil crisis over thirty years ago has been the development of a burgeoning market for derivative securities[7] that allow punters[8] of all ilk’s to speculate on such things as the price of oil. Futures contracts that allow investors to buy or sell commodities such as wheat and grain for delivery in the future have been around since the 19th century. Trading in derivative securities (includes futures) began in earnest with the financial deregulation policies of Reagan and Thatcher. This had financial markets opened up to foreign investors and led to the creation of new financial products/securities.

The BIS (Bank for International Settlements) calculated the notional value of outstanding derivative transactions in June of 2005 was $270.1 trillion[9] . The bulk of this is made up of Foreign Exchange contracts, but certainly commodities like oil are included. Also, this number does not contain exchange traded contracts where numerous energy products trade [10] , nor does it contain trading volume that is significantly higher. To put this number in perspective the notional value of derivatives securities prior to 1973 (First Oil Shock) would have been close to zero.

How Do Speculator’s Drive Prices

The Futures Industry is quick to point out that the buying and selling of futures is a very risky proposition. When someone buys or sells a futures contract on something such as oil, they are subject to the risk of the price of oil changing. The idea that punters can influence the price of a commodity such as oil would be simply impossible according to the industry’s front men. They would argue that price of commodities fluctuate based upon the underlying fundamentals for the commodity. They would again parrot the supply/demand imbalance created by increased demand from India and China and heightened political risk in the Middle East as the factors behind oil’s precipitous price rise.

They are wrong. Speculators are the incipient factor for rising oil and gasoline prices.

It is said that investors exhibit herding behavior with their investments. That is they move together as would a herd when investing—in lock step or in co-movement(herding[11]). The World Bank has noted that during a contagion, a panic when investors look to flee a country, that herding behavior increases significantly[12] . The World Bank similarly notes that this sort of herding behavior is similarly increased during euphoric periods, or what Ex Fed Head Alan Greenspan called “irrational exuberance” back in 1996 about the bubbling USA stock market. Meaning a bull market whether it be stocks or oil, significantly increases herding behavior.

It seems only natural to conclude then that rising oil prices has lead to increased herding behavior of punters and investors over the energy market.

Yet herding and the comparison to cattle, with the exception of a stampede, is much too passive a type of the behavior to explain the predatory conduct of speculators in the futures market, particularly when it comes to oil. Rather their behavior is more akin to the pack behavior of wolves or dogs that go after the weakest at their moment of vulnerability.

Consider the trading strategy of running stops (stop-loss orders, or buy-los orders). Stop-loss orders are orders an investor gives his broker to buy or sell a security should it hit a certain prices. Traders are keen to know such valuable information because they use it to their advantage in trading. Even if they are not privy to an order book of a major trading house they can use technical analysis

[13] to determine key price points that would influence others. One of the ways they can exploit this information is to try and run the stops, or push the price of the commodity to trigger the stops (buy orders, buying). For example, knowing that there are numerous orders outstanding to buy oil five cents above its current price, they might try and buy so much oil that it pushes the price up five cents. If they were to accomplish this it would trigger buy orders to buy more creating a sort of domino effect as buy orders trigger more buy orders pushing oil higher in price. They could then sell the oil they bought at a lower price.

Consider the trading strategy of running stops (stop-loss orders, or buy-los orders). Stop-loss orders are orders an investor gives his broker to buy or sell a security should it hit a certain prices. Traders are keen to know such valuable information because they use it to their advantage in trading. Even if they are not privy to an order book of a major trading house they can use technical analysis

[13] to determine key price points that would influence others. One of the ways they can exploit this information is to try and run the stops, or push the price of the commodity to trigger the stops (buy orders, buying). For example, knowing that there are numerous orders outstanding to buy oil five cents above its current price, they might try and buy so much oil that it pushes the price up five cents. If they were to accomplish this it would trigger buy orders to buy more creating a sort of domino effect as buy orders trigger more buy orders pushing oil higher in price. They could then sell the oil they bought at a lower price.

Running stops, or trying to push the market, maybe only for a moment, is a common tactic employed my many speculators. The reach of this tactic goes well beyond the trading floor/pit to affect major financial, economic and commodity markets[14]. In 1992 speculators were able to bring about the departure of Britain from the ERM (European Rate Mechanism) and its eventual collapse.

Consider how the UK’s Guardian reported the event the day after the carnage on September 17, 1992 :

“THE GOVERNMENT last night suspended Britain's membership of the Exchange Rate Mechanism after a tidal wave of selling the pound on the foreign exchanges left it defenceless against international currency speculators.

Britain's decision pushed the ERM to the brink of collapse early today, with the EC monetary committee locked in crisis talks aimed at holding the system together...

The announcement sent sterling tumbling in New York trading last night, hitting DM2.69 - nine pfennigs below its former permitted ERM floor against the German mark….

In total, the City believed that 40 per cent of Britain's foreign exchange reserves were spent in frenetic trading”.[15]

Britain would not be the last country to fall prey to speculators. Over the next few months speculators smelling blood would continue to chase and corner their quarry forcing other ERM member countries to undertake draconian measures or devalue their currencies. Some responded with extreme measures such as the Bank of Ireland who briefly raised over night interest rates to 1,000%.

Consider words of Gregory J. Millman in The Vandals’ Crown; How Rebel Currency Traders Overthrew the World’s Central Banks, (The Free Press, 1995) in speaking of the power of speculators to conquer as witnessed with the assault to Sterling among others:

“Like the vandals who conquered decadent Rome, the currency traders sweep away economic powers that have lost the power to resist.” (Page xi)

What country, commodity or institution has the power to resist this marauding gang of speculators? If Britain could not do in 1992 what can we hope for today after the explosive growth of derivatives trading and increase in speculative investment pools?

Consider words of Gregory J. Millman in The Vandals’ Crown; How Rebel Currency Traders Overthrew the World’s Central Banks, (The Free Press, 1995) in speaking of the power of speculators to conquer as witnessed with the assault to Sterling among others:

“Like the vandals who conquered decadent Rome, the currency traders sweep away economic powers that have lost the power to resist.” (Page xi)

What country, commodity or institution has the power to resist this marauding gang of speculators? If Britain could not do in 1992 what can we hope for today after the explosive growth of derivatives trading and increase in speculative investment pools?

Compounding the problem is the sacrilegious belief among punters and free marketeers that they are the righteous force of the market’s “invisible hand” enforcing discipline on the weak and irresponsible. “Like bounty hunters in the Old West, the traders enforce the economic law, not for love of the law; but for profit.” (ibid. page xii)[16]

Market participants so fervently believe that they are exerting discipline upon the market that they would put even ardent religious fundamentalists to shame. What are the fundamentals that trader’s believe? Were they more right than the European central banks about the ERM? They would say that they were right because they won! Would they similarly say they were wrong if a market or country was able to withstand their assault, or would they say next time?

|

Speculators Also Pushing Copper "David Threlkeld, a veteran copper trader, said the market had been "out of control" for months, allowing speculators to run roughshod over industrial producers and users. "The LME has been seduced by hedge funds, [which have] pushed prices to levels unsupported by fundamentals. There's a vacuum below and the crash could set off a chain of margin calls running through the whole commodities sector. We've got a crisis on our hands and it is a lot bigger than copper," he said. |

What are the correct economic fundamentals that will keep the speculators at bay in the oil market? No doubt oil speculators did not believe the fundamental outlook of Francisco Blanch, an oil strategist for Merrill Lynch in London, who was forecasting $40 a barrel by the end of the decade a few months back.[17] Are fundamentals working for the USA that has been able to maintain a massive current account deficit for over a decade that would have sunk other countries years ago? Are fundamental’s at work in the USA stock market that has been trading at a Price Earning Ratio above historical averages for decades? Are the…? The problem is that market fundamentals have many interpretations and meanings. The market is also fickle, so what they believe to be the correct fundamentals today could be different tomorrow.

What speculator’s have today is the power to make themselves right! Their weight of money has become so powerful that it is self-fulfilling. As they say “buying begets buying” and rising prices by themselves have a multiplier effect by triggering others to act. For example, rising oil prices encourages others (often non-traditional players) to jump aboard the trend of rising prices and buy oil. It encourages individuals to hoard gas and oil, and it encourages corporations to lock in current prices to prevent future price rises by buying futures, it encourages buying in other commodities such as natural gas, it…. among other things. All of which increase demand and prices. In doing so, it contributes to speculators ability to move markets and to make their fundamentals right. To them, might is right!

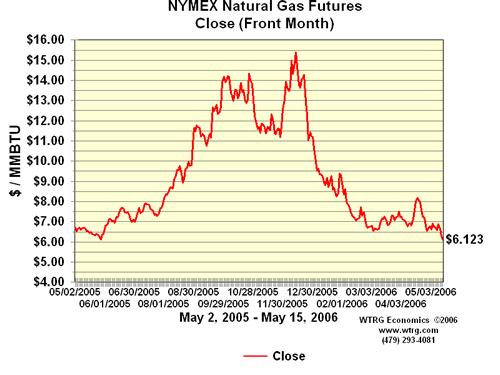

Exhibit A: The price of Natural Gas

We need only look to the price of natural gas this past winter (2005/06) to see how traders exploited our country’s vulnerability for their own personal profit. When Katrina hit, it was as if a red flag had been raised saying—Buy, Buy, Buy... Speculators pounced and began buying.

The chart below shows the price for natural gas over the last year. Notice how the price took off when Katrina hit in August of 2005 and that by April 2006 it was trading at a price below that ($6.123). In a period of a few months natural gas prices doubled, and then halved in price even quicker.

Consider the words of Greg Burns of the Chicago Tribune ”Why Your Natural Gas Bill Soared This Winter, Traders take prices on a roller coaster ride” , January 15, 2006:

“Once considered dull and predictable, the market for natural gas has become the hottest around, sparking controversy as sky-high heating bills arrive in the midst of some of the wildest commodity trading ever….

Home heating bills rarely move in lock step with commodity markets, since many utilities smooth the ups and downs by averaging gas charges over time and hedging their exposure. But some critics believe the boom in trading has raised the cost of a basic necessity far past the point that fundamental factors such as the weather alone would justify.

"People getting a bigger-than-average heating bill aren't going to like hearing that a natural-gas trader got an eight-figure bonus, but that's the reality," said Frank Partnoy, a law professor at the University of San Diego and author of a book on corruption in the financial markets. "In this game of trading natural gas, the traders are usually the winners and the utilities are usually the losers."

When the hurricanes hit, speculators were in their element. Rita and Katrina plowed through gas-production rigs in the Gulf of Mexico, raising the specter of severe shortages. Only a couple of months later, temperatures plunged across the Midwest and Northeast, where heating demand is greatest. Prices that had hovered around $2 per million BTUs years ago shot up to $15.78 as of Dec. 13

“That price made sense only if a new Ice Age had dawned”, said analyst Kloza, but the market seemed to defy gravity until the cold snap broke a few days before Christmas.

"These are markets where overreaction follows overreaction. It's manic or it's depressive. It never gets even," said Kloza. "You have the equivalent of a Dow that moves 4,000 or 5,000 points in a month."

Sure enough, prices plunged in concert with the thaw. Futures for February delivery at the New York Mercantile Exchange closed Friday at $8.79 per million BTUs, the lowest closing price since Aug. 9.”[18]

There never was a shortage, as natural gas supplies stayed at or above historical averages during the supposed shortage. It was consistently reported that there was no shortage. Take the Wall Street Journal on December 14, 2005 (“Natural Gas Hits a Record as Cold Sets in,” Spencer Jakab):

“Although there is no indication that gas supplies are under strain in either the short term or for the season as a whole, traders seem to have seized on the bullish momentum created by extremely cold temperatures in major heating markets that are expected to continue through at least Dec. 27.”

Two months later the Wall Street reiterated the same again in “Natural Gas Rides a Roller Coaster, Prices are on a downturn amid concerns of oversupply; Shortage Woes Evaporate,” Spencer Jakab, February 21, 2006:

Two months later the Wall Street reiterated the same again in “Natural Gas Rides a Roller Coaster, Prices are on a downturn amid concerns of oversupply; Shortage Woes Evaporate,” Spencer Jakab, February 21, 2006:

“Just two months after prices hit an all-time high amid fears of physical shortages this winter, the market is awash in a record amount of gas, and there are fears of a ruinous glut this spring.

A U.S. government report last week showed that gas in underground storage was 44% above historical norms for this time of year, and there are now widespread predictions that an all-time record amount of gas will be left over at the end of the heating season.”

The problem was compounded by multiplier effect of that the run on natural gas cause, which cascaded throughout the economy. Fearing further price rises, utilities, corporations and others added to the frenzy and made commitments to buy natural gas in the future and lock in prices. All this buying helped push up prices and hurt homeowners and others that relied on natural gas for heat. De facto, Americans were squeezed by punters who were successfully able to ramp up the price of natural gas.[19]

The “roller coaster ride” in the price of natural gas as described by the Chicago Tribune and the Wall Street Journal in the face of abundant supplies shows the power speculators have to move markets. That same “roller coaster ride” is being played out in a much larger and protracted way in the oil market. At some point oil will go bust and speculators will again be profiting on the downswing and telling us how “fundamentals” are at work AGAIN!

Catechism of Greed

Organizations supporting speculative trading will tell you about the benefits that futures/derivatives trading provide to facilitate the smooth operation of markets and the economy. They will point out how futures trading increases liquidity and provides a valuable resource for farmers and commodity producers to hedge their products. They will vehemently state that futures/derivatives trading do not increase costs. They would point out that this is because the trading activity of futures traders does not alter the underlying supply/demand balance. To the industry the idea that speculators are manipulating prices is a non-starter.

Futures/derivatives trading definitely increases liquidity, but who benefits from increased liquidity? Certainly not those dependant on a salary, or fixed income, who struggle to pay for their gas or utility bill. The beneficiaries are those with large pools of money--large financial institutions, agri-businesses, corporations involved with the production or sale of commodities, speculators and the wealthy. Simply put, increased liquidity helps the rich get richer by having their wealth earn more and helps fleece the poor and working classes of America who do not have enough money to speculate.

The advent of derivatives/futures trading has allowed Americans to be held hostage to the fickle fingers of speculators in basic commodities such as oil in a way previously not possible. Increased liquidity in derivatives markets has given speculators the ability to move greater and greater amounts of money and to thereby exert greater and greater influence on markets. The ripple effect of increased liquidity in commodities markets has been enormous. For example, with the number of family farms in decline one must wonder if increases liquidity in commodity trading has been another avenue special interests have used to promote the further “industrialization of US agriculture.”[20]

|

Sterlized Intervention When a central bank intervenes in the foreign exchange market, buying or selling its own currency, it changes (increase/decrease) its domestic money supply. To negate the effects of intervention on its domestic money, it “sterilizes” the intervention, by doing an offsetting transaction in the domestic market. Sterilized intervention is very similar to the trading of futures/derivatives because there is a transaction (buy/sell) that is later offset, meaning that there is no change in underlying supply demand equation. Who’s right, the world’s central bankers or the speculators? Foreign exchange speculators will tell you that sterilized intervention is ineffective because it does not alter the underlying supply demand equation—aka the fundamentals. Research from the Federal Reserve Bank of San Francisco finds that sterilized intervention is often effective. Sterilized intervention, like speculative trading, can have a pronounced psychological impact. Strong buying or selling, whether it is a central bank or pack of speculators, can send a powerful message. It will make traders question their own outlook and wonder if there is more to follow from the central bank, or is there something that they do not know, or… |

A little common sense will tell you that speculators increase costs. Where do the hundreds of billions of dollars that they have made through speculative trading come from?—certainly not from thin air. There is no free lunch. If speculators made hundreds of billions of dollars someone else had to loose hundreds of billions. And who lost? We lost, average Americans who did not have enough money to give to some punter to speculate for them.

Economic theory shows that speculators can and do influence prices. One need only look to sterilized intervention by central banks in foreign exchange markets to see that the antics of speculators move markets. Central Banks intervene in foreign exchange markets to influence prices. When they sterilize the intervention the process is almost identical to futures trading. If Central Bank intervention moves foreign exchange rates how can traders claim that their activity does not influence prices?

What Now?

Had not a burgeoning derivatives market developed since the last oil shock oil prices would be much lower today. How much? Estimates are hard to come by. A few years back Germany estimated that if speculators were not involved in oil trading it would be have been 25% lower in price[21] . Some analysts say that oil would be trading at $35 to $40 a barrel if it were not for speculators . The price of natural gas this past winter (2005/06), it doubled before going back below pre-speculative levels, adds credence to that $35 to $40 (the range of oil a few years back before speculative activity exploded).

|

Cost($) to America of Higher OIL If we assume that oil should be trading at $40 per barrel how much extra does it cost Americans to pay for oil because of speculators. It is estimated that Americans consume 20,030,000 barrrels a day. |

| Price Per Barrel | Daily Cost($) | Yearly Cost($) |

| $60 | $400.6 Mil. | $146.2 Bil. |

| $70 | $600.9 Mil. | $219.3 Bil. |

| $80 | $801.2 Mil. | $292.44Bil. |

The bigger question is what do we do now? Would curtailing derivatives trading, or even completely shutting it down lead to a dramatic price decline? Yes, removing the ability of speculators, whether they are individuals, hedge funds, or traders sitting on the desk of Goldman Sachs or Exxon, would help lower the price of oil. It would have the same effect as removing a middle man from any transaction. Since a trend, arguably a panic (feeding frenzy), has set in, it would take more than reducing the ability to speculate to bring prices down.

The question is, can we shut down speculative trading?—probably not. If trading is closed in the USA, or in the USA and other major developed countries such as Japan, Britain, etc., trading would still take place and most likely exchanges would open up in other countries such as Russia, Iran, or China. There is also a high probability that a Eurobond [23] market type development would occur whereby a commodity exchange would open up independent of any country .[24]

This is frightening because it was the development of the Eurobond market independent of countries in the 1960’s that brought an end to the Bretton Woods agreement and began our current Floating Exchange Rate Regime[25] . In other words we would be transferring more power and control to speculators and special interests.

There is a lot that the Bush administration can do immediately to reduce the price of oil. The President needs to work with Congress and develop a market based strategy for oil that has it using the futures market, as the Federal Reserve uses the capital markets, along with its strategic reserves[26]. Just knowing that the USA government has the ability to sell futures and back it up by tapping its Strategic Petroleum Reserve will shave 5-10% off the price of oil.

Congress should move ahead with a windfall profits tax on giant oil companies. Not only have the oil companies unjustly benefited from the actions of speculators in oil but they most likely were speculating along with them. Congress needs to fully investigate the use of derivatives by big oil companies. In particular they need to determine whether they played any role in the stampede of speculative buying that sent energy prices higher when Katrina hit. They need to be seriously restricted and regulated.

Congress should move ahead with a windfall profits tax on giant oil companies. Not only have the oil companies unjustly benefited from the actions of speculators in oil but they most likely were speculating along with them. Congress needs to fully investigate the use of derivatives by big oil companies. In particular they need to determine whether they played any role in the stampede of speculative buying that sent energy prices higher when Katrina hit. They need to be seriously restricted and regulated.

Congress should consider a windfall profits tax on commodity funds and hedge funds and scrutinize them closely. They along with Oil Company executives should be made to testify before Congress. For an industry more secretive than the Bush administration this would be like opening the drapes on Dracula on a bright sunny day. The American people need to see the faces of those that have been sucking them dry. Hedge fund managers, commodity traders, oil/gas traders, players in the derivatives markets need to be questioned. We need to hear them justify their eight figure bonuses and billion dollar profits while many Americans were forced to go to the pawn shop to pay for gas. Would Americans feel that they were providing a vital service and enforcing discipline on the market, or would they conclude that they were being ripped off?

Americans also need to know whose money the speculators manage. Are their conflicts of interest? Have speculator’s been used as a ploy by the oil industry?, or OPEC? Have speculators been managing money for wealthy individuals with terrorist ties? Making speculators testify would have a psychological impact that would make them a bit more cautious[27].

Longer term we need to reassess our overall energy policy. Most importantly we need to have one that treats energy as a necessity for all Americans, not a toy to make money from and make millions suffer. Oil and gas are vital commodities that no one should have monopolistic control over whether it be the physical product itself, or its price.

The price of oil and how it is hurting Americans is a problem, but it is not the biggest problem. The way speculators were able to move such a large market like oil when cartels such as OPEC could not, is very worrisome. Financial deregulation has created a very large beast (speculative investment pools) that can have its way and that we cannot control. Higher oil is painful, but it is symptomatic of a much larger problem and threat.

We first saw the power of large pools of money (Eurobonds/Eurodollars) in the late 1960’s and early 1970’s to flex its muscles and get governments to bend to its whims. The situation then was very similar to today—a large USA external imbalance; a dollar pegged too high relative to its major trading partners and increased commodity demand from the developing countries (India/Russia). The response was the end of Bretton Woods and the beginning of the Float (Our current monetary regime of Floating Exchange Rates.)

We first saw the power of large pools of money (Eurobonds/Eurodollars) in the late 1960’s and early 1970’s to flex its muscles and get governments to bend to its whims. The situation then was very similar to today—a large USA external imbalance; a dollar pegged too high relative to its major trading partners and increased commodity demand from the developing countries (India/Russia). The response was the end of Bretton Woods and the beginning of the Float (Our current monetary regime of Floating Exchange Rates.)

When the Float began many central bankers feared that large pools of capital moving unfettered across borders made them vulnerable. They feared a hostile takeover by large pools of capital, or feared that foreign companies would physically buy up their country’s assets. They feared that another country could become like a hostile investor and try and exert its influence on them. They feared becoming puppets, or ineffectual in their ability to set monetary policy because roving bands of capital would become too powerful and disruptive. Ex-Fed Head to be, Alan Greenspan, was representative of the thinking of many at the time when he said in 1972 that: “foreign governments might use their holdings of United States dollars to take over foreign subsidiaries of American corporations.”[28].

Feeling vulnerable to global capital flows, countries were slow to open up their markets to foreigners or taxed them to keep contro[29] . Over time those fears resided and government officials threw caution to the wind as financial markets bubbled higher, global trade accelerated and the forces of globalization were unleashed. To those living in the world of money it seemed that we had reached a new plateau of prosperity.

The reality is that the worst fears many had when the Float began have materialized. Governments have lost control. A marauding gang of speculator’s has seized the day. They have moved the price of oil to levels few thought possible. Their actions have had enormous ripple affects, windfall profits for oil companies and OPEC, exasperating America’s deficit and undermining national security by financially empowering countries hostile to America. They have also caused pain to and bankrupted many Americans.

We need to take a hard look at speculators, speculative pools, derivatives markets and financial markets overall. If speculators were able to manipulate such a large and strategically vital market as oil, what else is possible?—anything and everything!

We have to hope that sky high oil prices will get America to take a hard look at its soul and ask who we are. It is time we asked ourselves if financial deregulation and free markets are in keeping with American democracy if this means we are held hostage by a mob of speculators. Clearly the rape and pillage crowd that has been an underlying force since immigrants first stepped on our shores will resist. If they prevail oil prices are only the tip of the iceberg of what is to come. Oil is a problem, but perhaps it is a problem we can overcome to make America a better place to live in.

Madis Senner, CPA. Is a former global money manager turned faith-based activist. His causes include the support of an un-justly jailed physician, Dr. Rafil Dhafir, who was convicted of breaking the sanctions against Iraq for his humanitarian aid to the country: Free Dhafir. He has written about global capital flows for the New York Times, Barrons and the IFR among others. He is an author of a book on derivatives markets Japanese Euroderivatives, Euromoney, 1990. He can be reached at Oil Speculators.

Footnotes

[1] "Are Speculators Driving Up The Price Of Oil?", August 30, 2004, Christopher Palmer.

[2] "Oil speculators put even the masters of Opec in their place", Graham Searjeant, Financial Editor; August 20, 2004.

[4] Germany’s Ex Chancellor Schroder

[5] “Other BP executives hinted that hedge funds and other speculators were partly responsible for the current record levels of $73 a barrel.” "Fear and speculators driving oil prices too high, says BP chief", UK Guardian, Terry Macalister, April 26, 2006.

[6] Why are Oil Prices So High?"--BBC

[7] Derivative securities are a funny breed of investments. The term derivative means that it is based upon, derived from, some other security/asset/commodity called the underlying security. Often derivatives give the buyer the right to buy or sell a stock/bond/commodity at some future time with very little money down. This means that the purchaser is betting solely on the price of some underlying asset. They are also doing it with a fraction of the cost necessary to buy/sell the underlying asset itself, so they can leverage themselves.

Derivatives can be tailor made to suit an investor’s needs or preferences. For example, an OTC (over-the-counter, non exchange traded) derivative can restructure a bond that makes fixed interest payments to one that is variable and who payments fluctuate with interest rates. Derivatives can be structured to make its value dependent upon some future event such as the outcome of an election. The opportunities are limitless.

[8]

Punter: 1. a trader who hopes to make quick profits. Basically, another term for speculator.

2. In the U.K., it is generally used to describe someone who gambles. It is also used to mean a client or customer of any business.

Notes: A punter speculates as opposed to invest. Thus, punters aren't concerned with the fundamentals of an investment, but rather attempt to make a quick profit by selling to somebody else at a higher price. Punters speculate in any markets, but especially like options, futures and foreign exchange because of the leverage.

[9] BIS Table On Derivatives Outstanding

[10] The Futures Industry Association estimated that 9.9 billion exchange traded contracts were traded in 2005.

[11] To read a definition of herding see Wikipedia. For research see the following among others: Behavioral Finance,"When Will Invetors Herd".

[12] Contagion of World Financial Crises

[13] Explanation of Technical Analysis

[14] There are many similar strategies of using muscle and force for profit. For example, currency desks conduct what they call ‘bear raids’ where they have all their traders simultaneously call up their competitors asking to buy/sell large quantities of a particular currency. Their goal is to create a big temporary imbalance that leads to a panic that moves the price in their favor.

[15] ”Pound Drops Out of ERM”, UK Guardian, Larry Elliot, Will Hutton, Julie Wolf, September 17, 1992

[16] Ed Yardeni of Prudential Bache securities coined the term “bond vigilantes” during Reagan’s debt binges of the 1980’s to describe how bond markets would force interest rates higher to prevent the central bank, the Federal Reserve, from pumping out easy money. But with real interest rates (rate of interest minus the inflation rate) having been so low for so long one must wonder what the bond vigilantes are enforcing today.

[17] “Investing Boom in commodities lures pension funds” Bloomberg News, Saijel Kishan, December 19,2005.

[18] "Traders Take Prices on A Roller Coaster Ride"

[19] The following report by the AARP talks about the consequences of higher energy prices to individuals: The Effect of Energy Costs on US Adults.

[21] "Schröder Takes On Oil Speculators"

[22]

See Alexander’s Oil and Gas Connection

CNNMoney.com writer Amanda Cantrell in “The Blame Game: Hedge Funds and Oil-- When oil prices spike, fingers point at 'speculators' like hedge funds. But does their trading really drive prices?” April 26, 2006, found that some in the oil market would agree with that analysis. She noted that;

“Mike Rothman, senior managing director of broker dealer and research firm International Strategy Institute and head of the firm's integrated oil research practice, authored a study last year that concluded that speculative trading may have added as much as $20 per barrel to the price of oil during a period in 2004, according to reports.”

[23]

When President Kennedy passed the Interest equalization tax in 1963—it taxed foreign borrowing by USA residents and foreigners borrowing in the USA—it encouraged foreigners and corporations to keep their dollar holdings in offshore banks. This led to the development of the Eurodollar and Eurobond markets that were outside the control of the USA and all other countries catering to this pool of money. The “Euro” title comes from the fact that many of the banks issuing “Euro” investments resided in Europe. For a discussion of the Interest Rate Equalization Tax and a general overview of monetary policy in the 1960’s see:Monetary System

A Eurobond is essentially a bond issued outside the domicile of the corporation or country issuing it. Subsequently, it is not subject the laws of the country where the issuer resides.

[24] A recent article in the Futures Industry Magazine pointed out competition between exchanges for trading is already quite keen: Direct Competition and Futures Exchanges.

[25] Under a floating exchange rate regime the market determines exchange rates. Previously currency regimes had been fixed between countries or linked to gold. Under the Bretton Woods agreement currencies were fixed in price to the US dollar that was then linked to gold.

[26] I am loathing having the government begin trading commodities for a variety reasons. However, I think that they can no longer stand idly stand by. They have to do something. This will mean legislation will have to be passed.

[27] No doubt many punters would laugh that Congressional testimony would not influence them. But the specter that Congress may do something to hurt their business, or them personal, will have some effect.

[28]

Ex Fed Head Alan Greenspan is reflective of the thinking of many at the time (New York Times, “DOLLAR PURCHASE OF U. S. UNITS SEEN, Economist Says Foreigners Might Used Holdings to Acquire Subsidiaries”, March 12, 1972):

“One of Wall Street’s leading economists raised the possibility yesterday that foreign governments might use their holdings of United States dollars to take over foreign subsidiaries of American corporations… In a letter to his clients, the economist, Alan Greenspan, president of Townsend-Greenspan & Co., Inc., noted that foreign central banks now have a $53 billion hoard of United States dollars…Since these dollars are essentially non convertible, and are likely to remain so, he asked "What are they good for?"…"the answer very likely in the minds of many foreign governments is the purchase in the profitable American affiliates domiciled abroad. While outright nationalization (to be paid for in dollars) should not be ruled out, it cannot be considered imminent."

[29] For example it was not until 1985 that foreigners could buy Japanese Government Bonds. To induce foreigners to buy USA Treasury bonds Reagan removed the foreign tax on them. To invest overseas domestic funds managers in the UK had to buy a “dollar premium” that gave them the right to invest overseas. [0]